Politicians and various bad-at-math members of the mass media are doing a heroic job of informing Americans that we are paying higher-than-ever prices for gasoline to fill our cars. Fortunately for us, that is entirely false.

On the surface, it looks pretty bad. The average price at the pump rose 49.6 percent in 2021, the largest year-over-year increase since April 1980, according to data from the Bureau of Labor Statistics. But remember, the original price-per-gallon came from an incredibly cheap starting point.

The thing is, like gasoline itself, the price of gas is volatile, subject to myriad, seasonal fluctuations that tend to average out over time. We simply have poor retained memories that oil companies routinely sock it to the consumer for seemingly random reasons: pipeline breaks, seasonal demand, regional warfare, hurricanes or newly implemented reformulation expenses. We remember the price spikes and forget the slow regressions to the mean.

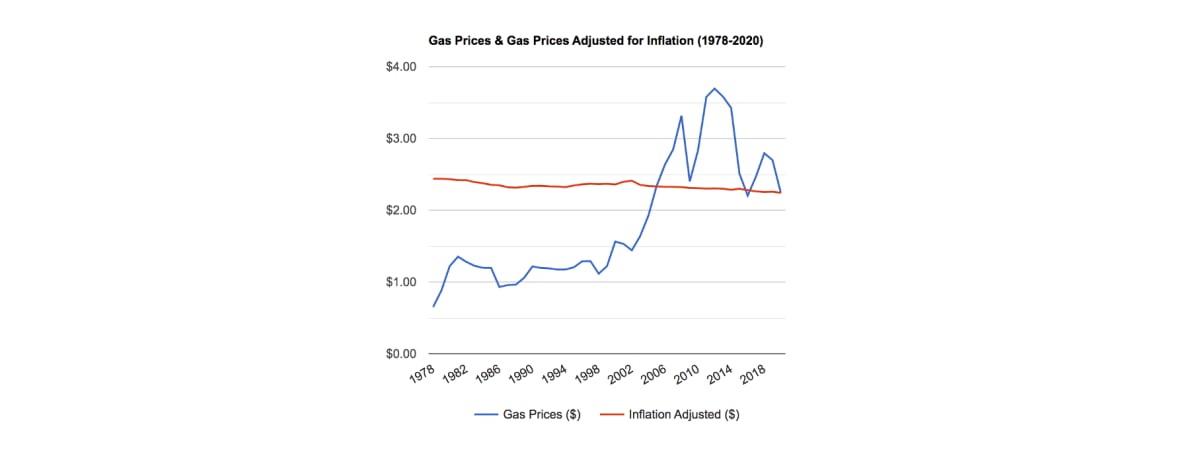

This spike has happened while overall consumer prices rose 7.5% in the 12 months prior to the end of January, a 40-year high in the Consumer Price Index that was reported on Thursday — so we’re understandably alarmed by gas prices when everything around us costs more. But when you look at the past 40 years of gasoline prices, you get a different picture. If we analyze gasoline prices going back to 1980, what we are paying right now at the pump is actually near a 40-year low.

What the current price-per-gallon hysteria fails to account for is decades of inflation. To correct for that, we have to measure purchasing power in “constant dollars,” accounting for the shifting value of a dollar over time. According to Platt’s Market Data, which tracks historical gasoline prices (on page 170 of this government report), the average price of a gallon of regular unleaded was $1.25 in 1980. Fast-forward 40 years to December 2020, and that would be the equivalent of $3.77 in today’s dollars when adjusted for inflation. Yet in that month, the national average price we were paying was just $2.17.

But what about the recent spike? By the end of 2021, unleaded had marched up to $3.48, which is right about where it stands as of today, according to AAA. In other words, it’s still less than if gas prices had merely matched the march of inflation for the past 40 years. You may think you are paying too much, but gasoline remains one of the great deals in the economy.

To be sure, what we are experiencing is still a big one-year price jump, but there were similar price spikes during the George W. Bush and Barack Obama presidencies — big increases in 2008 and 2012 as America entered and then extracted itself from the Great Recession. If indexed for inflation, the July 2008 all-time national average gas-price peak of $4.10 would be the equivalent of $5.31 in today’s dollars. We’re not there yet. Not even close. And remember, those prices include taxes.

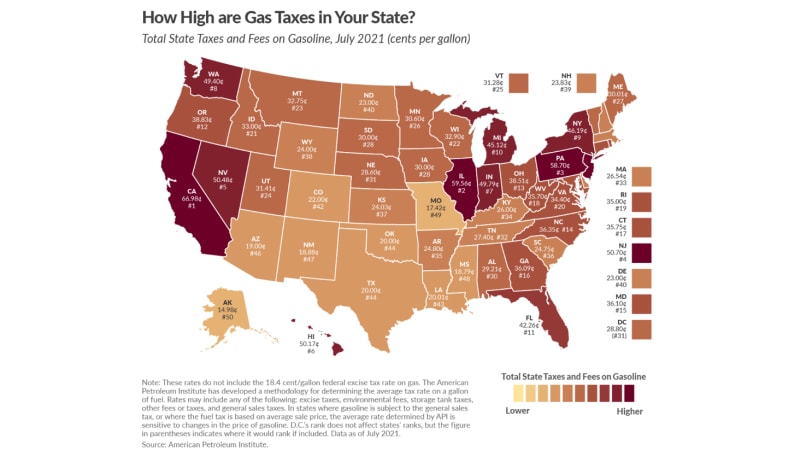

Ah, yes, taxes. Using information from the American Petroleum Institute, the Tax Foundation has created a handy map about how much of your pump price is actually made up of state taxes. To quote the Tax Foundation website: “States levy gas taxes in a variety of ways, including per-gallon excise taxes collected at the pump, excise taxes imposed on wholesalers (which are passed along to consumers in the form of higher prices), and sales taxes that apply to the purchase of gasoline.”

The range of these levies is startling. California (because, of course) has the highest average gas tax, at nearly 60 cents per gallon, while Alaska is the lowest, at about 15 cents per gallon. There’s also an 18.4 cents-per-gallon federal excise tax tacked on. Blue states tend to tax gas at higher rates, while red states ease the pain at the pump a bit. And those state taxes are likely to go up, due to federal mandates made upon states left unfunded by the billionaire tax cuts starting in 2018, according to the nonpartisan Center on Budget.

But despite all this, what if you still feel like you are paying too damn much to fill your tank? Perhaps you ask, why doesn’t America pump more oil out of the ground right here in the USA, or keep turning the taps to the Strategic Petroleum Reserve to create more supply and thus purportedly drive down prices?

Turns out, we don’t have to. In fact, in the first half of 2021, the United States exported more petroleum than it imported, according to the U.S. Energy Information Administration’s petroleum supply report.

Here’s the weird thing: The U.S. basically exports nearly the same amount of petroleum products that it imports – about $130 billion in each direction, according to census.gov. So why don’t we keep more of our domestically produced petroleum to make things easier on our citizenry? Because the government has no control over that. Oil companies sell to (and buy from) whichever buyer maximizes their profits, regardless of nationality.

That means you’ll witness the bizarre, wasteful sight of a supertanker offloading petroleum from the Persian Gulf at the Port of Los Angeles, just as a supertanker full of American sweet crude cruises by on its way to China. In fact, we export more oil to China than we import from Saudi Arabia. (For those jingoists keeping score, the U.S. imports five times more oil from Canada than we do from the Persian Gulf countries.)

If American refineries kept more of this oil at home, instead of selling it to China, would we pay less at the pump? Maybe. Supply does not always correlate to price.

Confused yet? You should be. What’s the takeaway? Presidents of the United States have almost zero control over the price of gasoline. It may be a leading economic indicator, but those wild swings are dictated solely by oil companies and Wall Streeters who speculate on the spot market.

According to the EIA, changes in the price of gas are due to taxes, marketing and distribution costs, refining and the cost of crude oil. Policies put in place by Donald Trump or Joe Biden (you can stop typing your Keystone XL rants now) have almost zero immediate impact on the price of crude oil, and thus the resultant price of gasoline. It’s all about immediate supply and demand. As such, blaming any president for high gas prices is like blaming your dog because your gardener is charging you more to mow the lawn.

Does that mean you’ll stop hearing about high gas prices on the cable news shout-athons or in the halls of Congress? Not hardly.

Mark Rechtin has been covering the automotive industry for three decades, and is a recipient of the Jesse H. Neal National Business Journalism Award.