SAN FRANCISCO — Elon Musk returned to the stand for a third day Tuesday in a class-action lawsuit brought by Tesla investors who allege he misled them with a tweet about a deal that never happened, testifying that his intent had been to let his shareholders know he was considering a buyout.

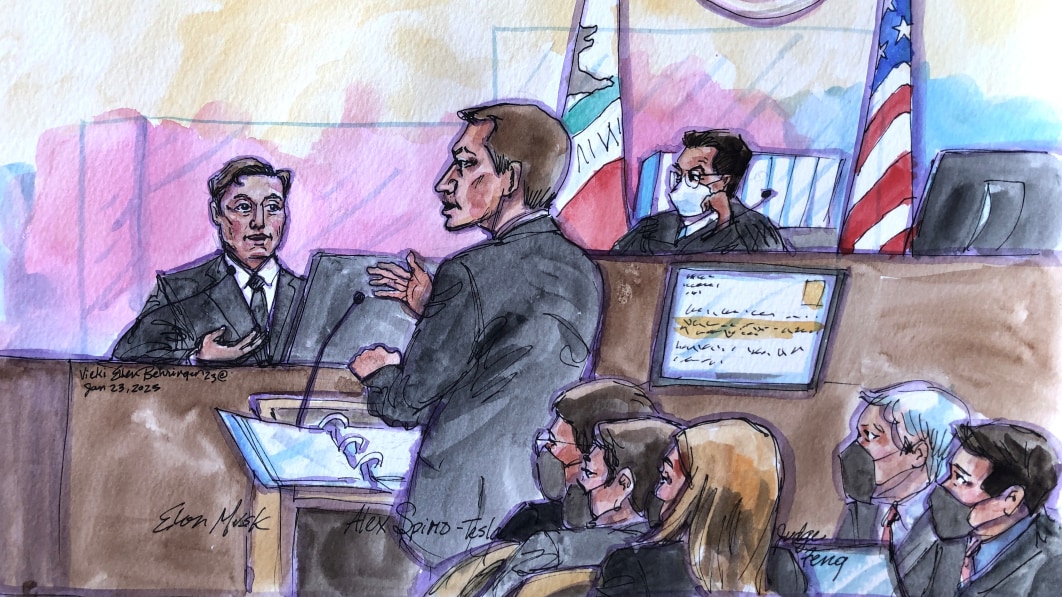

The 51-year-old billionaire resumed — under the friendly questioning of his own lawyer, Alex Spiro — his staunch defense at a trial centering on two 2018 tweets indicating he had lined up the money to take Tesla private.

As Spiro gently prodded him, Musk told the nine-person jury he had stated only that he was “considering” a Tesla buyout but never promised a deal would get done. But, Musk said, he thought it important to get the word out to investors that Tesla might be poised to end its eight-year run as a publicly held company.

“I had no ill motive,” Musk said. “My intent was to do the right thing for all shareholders.”

While being grilled the day before by an attorney representing Tesla shareholders, Musk at times was combative, indignant and exasperated. Through it all, Musk has insisted he had locked up financial backing for what would have been a $72 billion buyout of Tesla during 2018 meetings with representatives from Saudi Arabia’s Public Investment Fund, although no specific funding amount or price was discussed.

When presented with texts and email indicating that a representative for the Saudi fund had never pledged the money for a full buyout of Tesla, Musk contended it was nothing more than the words of someone trying to backpedal from a previous pledge made in private conversations.

Surfacing while Musk was on the stand Tuesday was his contempt for the attorneys who sued on behalf of Tesla shareholders who owned stock in the company for a 10-day period in August 2018.

“I don’t believe they actually represent shareholders,” Musk sneered, drawing a rebuke from U.S. District Judge Edward Chen, who ordered the remark stricken from the record.

In the class action lawsuit, Tesla investors allege Musk, who has since taken Twitter in a $44 billion buyout, misled them with a tweet saying funding was secured to take his electric car company private — for $420 per share. But the deal never came close to happening, and the tweet resulted in a $40 million settlement with securities regulators.

Musk has previously contended he entered into the settlement under duress and maintained he never wavered in his belief that he had the money for a deal.

He pointed Tuesday to his nearly 30-year track record as an entrepreneur who has never had trouble raising money from a litany of past ventures that have included PayPal and Neuralink, in addition to Tesla and SpaceX.

“It’s not a problem for me to raise money,” Musk said, chuckling. “I have done a good job for investors, and when you do a good job for investors, they give you money.”

The trial hinges on whether a pair of tweets that Musk posted on Aug. 7, 2018, damaged Tesla shareholders during a 10-day period leading up to Musk’s admission that the buyout he had envisioned wasn’t going to happen. The statements resulted in Musk and Tesla to reach the $40 million settlement without acknowledging any wrongdoing.

In the first of the 2018 tweets, Musk stated “funding secured” for what would have been a $72 billion — or $420 per share — buyout of Tesla at a time when the electric automaker was still grappling with production problems and was worth far less than it is now. Musk followed up a few hours later with another tweet suggesting a deal was imminent.