- According to a new online survey from Cox Automotive, there’s a lot of good news for electric-vehicle fans.

- Cox found that 40 percent of people planning to buy a pickup in the next two years would consider an EV pickup.

- Not surprisingly, the survey showed that buyers who would put an electric truck on their shopping list tend to care more about technology, while those sticking with internal combustion are more likely to prioritize horsepower.

It’s no surprise that some of the hottest new electric vehicles are the upcoming barrage of pickup trucks. Certified fresh options from traditional automakers including Ford and GMC (through its revived Hummer brand) as well as startups like Tesla and Rivian will all be arriving in the next few years, and people have noticed.

Those are the results from a new survey of pickup shoppers conducted by Cox Automotive, which found that 40 percent of consumers who plan to buy a truck in the next two years are considering an electric option, and a solid half of those in the market for an EV pickup truck find the current selection of electric vehicles appealing.

“Our research shows new EV pickup trucks are leading more consumers to consider an EV product,” said Vanessa Ton, senior manager at Cox Automotive, in a statement. “EV pickups are a catalyst for EV growth.”

To be sure, Cox did not conduct a massive, anonymous survey to discover these results. Instead, Cox worked with MarketVision to administer an online survey in November and December that ended up getting opinions from 155 consumers who are in the market for a pickup truck, including 60 who were specifically shopping for an electric pickup truck.

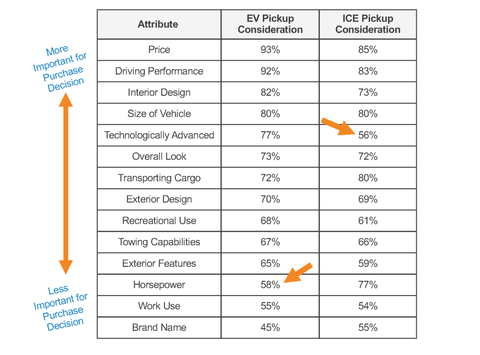

Not all truck shoppers are interested in the same things. Price and driving performance were the top two considerations, but after that, things diverge slightly, Cox found. One big difference is where horsepower or new technology rank on the list of important features. “ICE buyers prioritize horsepower; shoppers interested in EVs care more about technology,” Ton said.

Specifically, horsepower matters for 77 percent of of fossil-fuel truck shoppers but only 58 percent of EV truck shoppers. For a truck that’s “technologically advanced,” the difference is about the same but in the other direction. Seventy-seven percent of EV truck shoppers think an advanced truck is something to consider while only 56 percent of ICE truck shoppers thought so. And, for the traditional OEMs who think Tesla or Rivian have a steep conquest hill to climb, “brand name” came in near the bottom of the list for buyers interested in EVs (45 percent) and ICE (55 percent) truck shoppers.

That doesn’t mean Ford will undoubtedly lose tons of customers because of the Cybertruck or the Rivian R1T. When Cox showed people pictures of trucks from the four companies surveyed—Ford, GMC, Rivian, and Tesla—but without any brand and model indications, 59 percent said they liked the Ford F-150 electric pickup truck, while only 19 percent said the same about the Tesla. Once the names were attached to the pictures, interest in the Cybertruck jumped to 32 percent, while Ford dropped to 45 percent. That still made the F-150 the truck people were most interested in—”perhaps indicating familiarity is attractive,” Cox said—but it also shows the strength of the Tesla brand.

This content is imported from {embed-name}. You may be able to find the same content in another format, or you may be able to find more information, at their web site.

This content is created and maintained by a third party, and imported onto this page to help users provide their email addresses. You may be able to find more information about this and similar content at piano.io